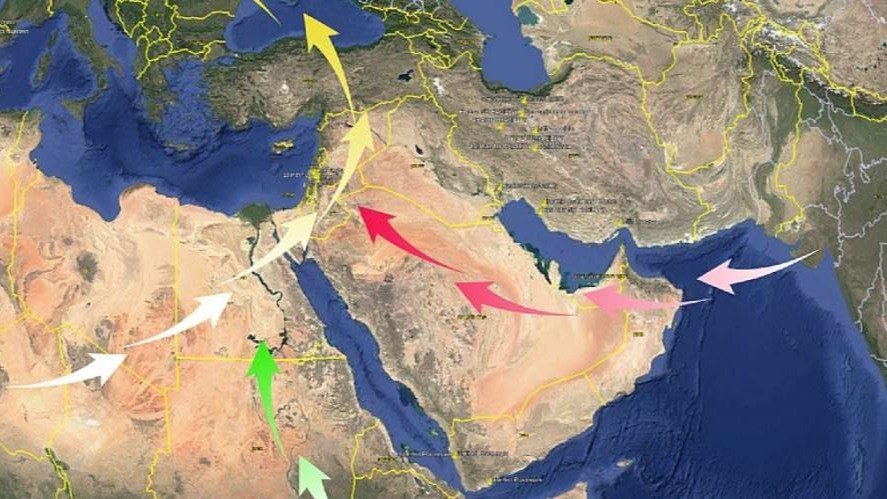

A recent feature imagines a high-speed, tri-continental trade spine linking India, the Gulf, Africa, and Europe—with the Gulf (and especially Saudi Arabia) as the central junction. Some elements are visionary (like a proposed 380 km India–Oman undersea link) and should be treated as conceptual, not confirmed. But the broader direction is unmistakable: Saudi Arabia is positioning itself as the indispensable land and sea connector between Asia, Africa, and Europe.

From concept to concrete enablers

The 2023 launch of the India-Middle East-Europe Economic Corridor (IMEC) set the political and economic frame to move goods, energy, and data between India, the Arabian Peninsula, and Europe. Saudi Arabia is a core node in that framework.

On the Saudi side, multiple proof points align with Vision 2030’s logistics ambitions:

- Mawani throughput is rising. Saudi ports handled 320.8 million tons in 2024(+14.45% YoY), with container dynamics reflecting an active transshipment role. Month-by-month in 2025 continues to show momentum.

- Dedicated logistics corridors are being added. In Jeddah, Mawani kicked off a 17 km port–logistics corridor(bridges, multi-lane access) to speed trucks and cut urban congestion.

- The Saudi Land Bridge (Riyadh–Jeddah rail) is moving forward, with construction preparation reported and a targeted completion horizon around 2030—a backbone for inland time-definite flows that connect Red Sea and Gulf coasts.

Saudi as the hinge between India and Africa Saudi-India trade remains deep and strategic (Saudi is India’s 5th-largest trade partner; India is Saudi’s 2nd). In FY 2023-24, trade volumes exceeded US$ 43 billion—a sizable base to grow as corridors mature.

To the west and south, Riyadh is scaling its Africa strategy. At the Saudi-Africa Summit (2023), the Kingdom signaled US$ 25B+ in prospective investments, US$ 10B in export financing, and US$ 5B in development financing—capital that can catalyze ports, rail, agro-processing, and logistics parks across the continent.

Where the corridor vision meets execution Think of the corridor in three layers:

- Sea gateways & ports– India’s Vadhavan; Saudi’s Red Sea and Arabian Gulf ports; Eastern Med ports—each expanding capacity and digitalization for larger ships and faster turns.

- Inland rail & road spines – Saudi’s Land Bridge is pivotal, slashing cross-kingdom transit times and enabling a true Asia↔Europe time-definite rail-sea chain anchored in the Kingdom. Analyses estimate financing gapsand specific logistics nodes (e.g., KSA–UAE linkages and Jordan connection points), underscoring the need for sustained, targeted investment.

- Logistics corridors & industrial zones – New port-to-park corridorsin Saudi (e.g., Jeddah) and Vision 2030-aligned logistics/industrial hubs (Riyadh, NEOM) pull manufacturing, assembly, and value-add closer to the flow of goods.

Why this matters now

- Resilience vs. chokepoints: Diversifying away from single maritime routes (e.g., Suez disruptions) by adding rail-integrated land routesthrough Saudi raises reliability for shippers. (See IMEC context.)

- Speed and cost:Time-definite inland links plus modern ports compress lead times and inventory—key for auto, electronics, pharma, and perishables.

- Capital is mobilizing:From global investors establishing Saudi platforms to public-private project finance, the Kingdom is drawing institutional capital into logistics and infrastructure.

The full blueprint will evolve, but the center of gravity is clear: Saudi Arabia is becoming the hinge that physically and financially connects India’s factories to African resources and European markets. For shippers and industrials, this is the moment to rethink network design—with Saudi as the control tower.